The Basic Principles Of Medicare Graham

The Basic Principles Of Medicare Graham

Blog Article

Medicare Graham Fundamentals Explained

Table of ContentsThe Basic Principles Of Medicare Graham The Greatest Guide To Medicare GrahamUnknown Facts About Medicare GrahamLittle Known Questions About Medicare Graham.Getting My Medicare Graham To Work

Before we speak concerning what to ask, let's speak about that to ask. For several, their Medicare journey begins straight with , the main internet site run by The Centers for Medicare and Medicaid Solutions.

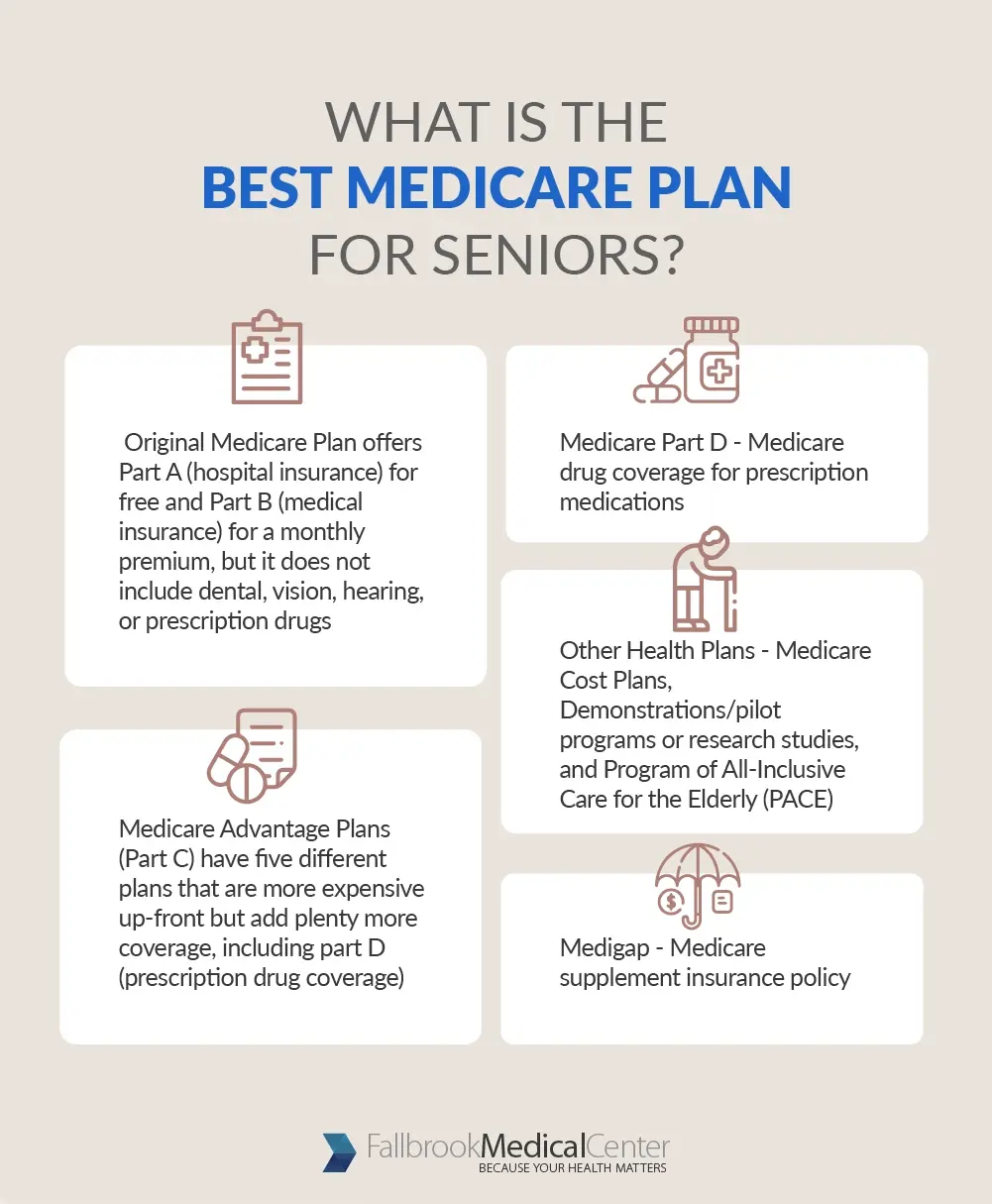

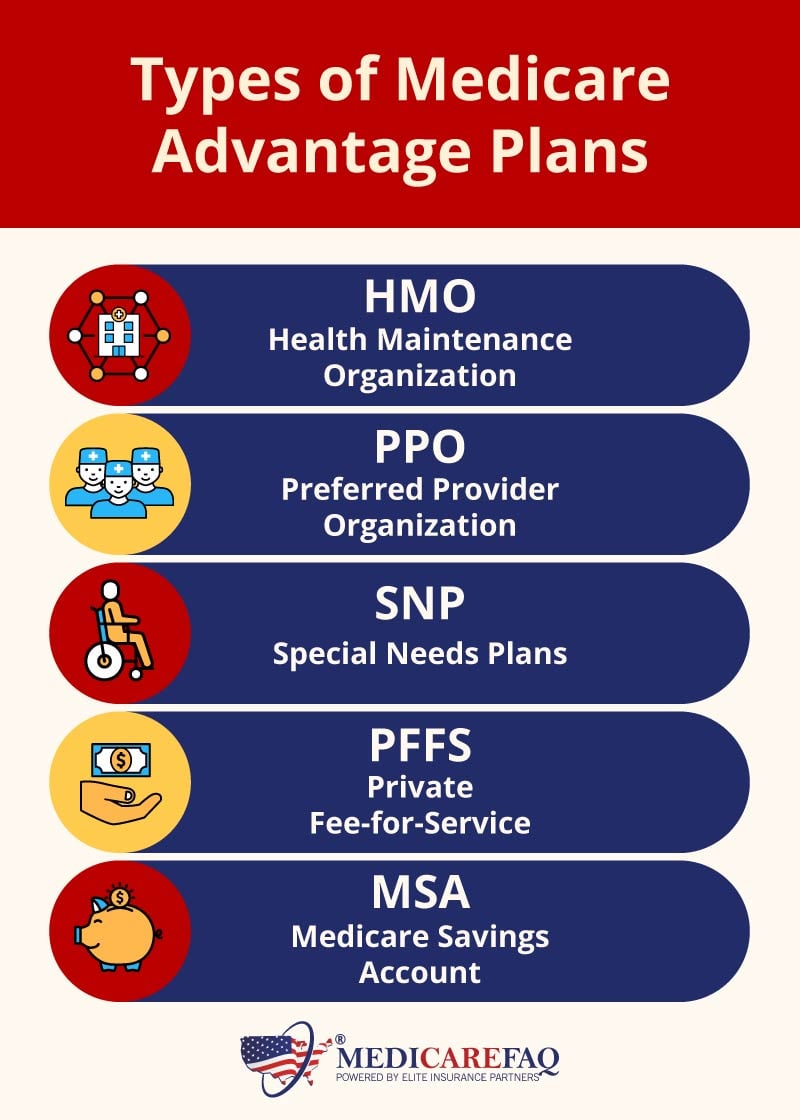

It covers Component A (hospital insurance coverage) and Part B (clinical insurance coverage). This includes things that are considered clinically essential, such as health center keeps, routine medical professional gos to, outpatient services and even more. is Medicare insurance coverage that can be acquired straight from a private healthcare company. These strategies work as an alternate to Initial Medicare while supplying more advantages - Medicare West Palm Beach.

Medicare Component D prepares aid cover the price of the prescription medications you take in your home, like your everyday medications. You can enroll in a different Part D plan to add medication coverage to Original Medicare, a Medicare Cost strategy or a few other kinds of strategies. For lots of, this is commonly the initial concern taken into consideration when looking for a Medicare strategy.

The smart Trick of Medicare Graham That Nobody is Talking About

To get one of the most cost-efficient health care, you'll desire all the solutions you utilize to be covered by your Medicare strategy. Some covered services are completely totally free to you, like mosting likely to the doctor for precautionary care testings and tests. Your plan pays everything. For others like seeing the medical professional for a remaining sinus infection or filling a prescription for protected prescription antibiotics you'll pay a fee.

and seeing a company who approves Medicare. But what regarding traveling abroad? Many Medicare Benefit strategies provide global insurance coverage, in addition to coverage while you're traveling domestically. If you plan on taking a trip, see to it to ask your Medicare consultant regarding what is and isn't covered. Perhaps you have actually been with your present doctor for some time, and you intend to maintain seeing them.

Medicare Graham Fundamentals Explained

Many individuals that make the switch to Medicare continue seeing their regular medical professional, yet for some, it's not that simple. If you're dealing with a Medicare expert, you can ask them if your medical professional will certainly be in network with your new strategy. Yet if you're looking at plans separately, you might have to click some links and make some telephone calls.

For Medicare Advantage plans and Cost strategies, you can call the insurer to make certain the medical professionals you wish to see are covered by the plan you have an interest in. You can additionally examine the plan's website to see if they have an online search tool to find a covered medical professional or facility.

Which Medicare plan should you go with? That's the most effective part you have options. And inevitably, the option depends on you. Keep in mind, when getting begun, it is essential to ensure you're as educated as feasible. Beginning with a checklist of considerations, see to it you're asking the right inquiries and start concentrating on what sort of plan will certainly best serve you and your requirements.

Medicare Graham for Beginners

Are you ready to transform 65 and come to be freshly qualified for Medicare? Selecting a strategy is a huge decisionand it's not constantly a very easy one. There are essential things you ought to recognize up front. As an example, the least expensive plan is not always the ideal choice, and neither is one of the most costly plan.

Also if you are 65 and still working, it's a great concept to assess your choices. Individuals getting Social Protection advantages when turning 65 will be immediately registered in Medicare Components A and B. Based upon your employment scenario and wellness treatment options, you might require to consider enrolling in Medicare.

Initial Medicare has 2 components: Component A covers hospitalization and Component B covers clinical expenses.

The Best Strategy To Use For Medicare Graham

There is generally a premium for Component C policies in addition to the Component B premium, although some Medicare Advantage prepares deal zero-premium strategies. Medicare Lake Worth Beach. Evaluation the protection information, costs, and any type of extra benefits provided by each plan you're considering. If you enlist in original Medicare (Parts A and B), your costs and insurance coverage will be the very same as various other people that have Medicare

(https://www.reverbnation.com/artist/m3dc4regrham)This is the most a Medicare Benefit member will certainly have to pay out-of-pocket for covered services each year. The quantity varies by plan, yet as soon as you reach that limit, you'll pay absolutely nothing for covered Part A and article Part B services for the rest of the year.

Report this page